Introduction

Closing a sole proprietorship is never an easy decision. However, understanding the essential steps can make the process less overwhelming. This guide will walk you through what you need to do financially and legally to close your business.

Financial Considerations

Settle Debts and Obligations

First, settle any outstanding debts and financial obligations. This includes paying off vendors and any short-term or long-term loans.

Handle Taxes

You must file a final tax return for your business. Make sure to consult with a tax professional to ensure all taxes are paid and accounted for.

Close Business Accounts

Once all financial obligations are clear, close your business bank accounts and credit cards to avoid future charges or fees.

Legal Steps

Notify Stakeholders

Tell your customers, employees, and vendors that you’re closing the business. Make sure to fulfill any remaining contracts or obligations.

Cancel Licenses and Permits

Contact the appropriate government bodies to cancel any business licenses or permits. This avoids ongoing fees and potential legal issues.

Record the Closure

Depending on your jurisdiction, you may need to file a formal closure or dissolution form. Check local laws to find out what paperwork is required.

Conclusion: A Smooth Exit Strategy

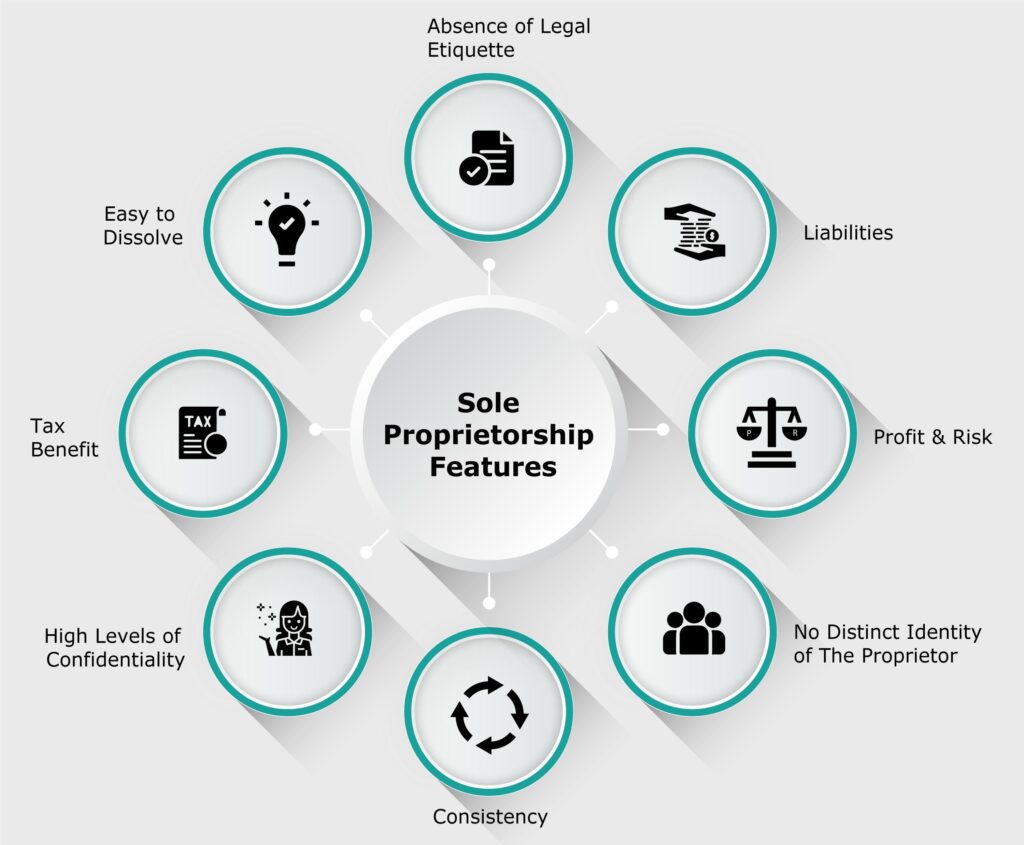

Closing a sole proprietorship involves many steps, both financial and legal. Following this guide ensures you take care of all responsibilities and exit the business world gracefully.

FAQs

Yes, it’s essential to inform all creditors to ensure you settle all outstanding debts and avoid legal issues.

You can sell off your business assets to pay any debts. The remaining profits are yours to keep